Trojan horse

The technique known as the Trojan Horse makes it possible to change the address of the recipient of the cryptocurrency transaction. CryptoShuffler is one of the software using this technique. This technique, rare, has little effect because it suffices for the sender of the payment to visually check the first / last characters of the destination address to ensure that it is not being fooled.

Price evolution against the dollar and the euro

Bitcoin to US dollar exchange rate since its inception, until 2020.

When it was created in February 2009, cryptocurrency was initially traded only as an experiment by a few rare users and its value was zero. On October 12, 2009, the first known bitcoin sale took place, where two users traded 5,050 bitcoins for $ 5.02 per Paypal transfer, which equates to a price of around $ 0.001 per bitcoin.

In March 2010, Bitcoinmarket.com was the first bitcoin exchange platform to open, thus allowing continuous quotation of the price of bitcoin.

On February 9, 2011, bitcoin reached parity with the dollar. On November 29, 2013, the value of a bitcoin exceeded that of an ounce of gold, to nearly $ 1,250.

Bitcoin, mainly traded for yuan and dollars, can also be traded for euros on a dozen platforms. Until November 2013, Mt. Gox was the most important of these platforms in terms of transaction volume (~ 70%) and the practice had been taken to consider its price as representative of the market. As a result of the problems encountered, users are turning away from it, causing the price of bitcoin to drop sharply on Mt. Gox, with prices observed on other platforms only slightly affected.

The price experienced a 400% increase between January and March 2013, before correcting itself severely on April 10, following a failure of the Mt. Gox exchange site and probable panic sales. The price falls back to the level of the previous month, around 50 USD. Between December 4 and 5, 2013, following a warning from the People’s Bank of China and the Bank of France, the price lost nearly 35% in 24 hours.

On February 19, 2014, the price collapsed following the announcement of the disappearance of 850,000 bitcoins on Mt. Gox. On this exchange platform, bitcoin goes from € 185, on February 18, to € 73, 24 hours later, while it remains close to € 400 on other platforms. Mt.Gox declared bankruptcy on February 28, 2014. On May 1, 2014, a group of investors called Sunlot Holdings offered to buy the site for a symbolic bitcoin.

In 2016, after the Brexit announcement on June 24, the value of bitcoin skyrocketed, gaining more than 9%, while all financial centers plunged for less than a week.

After a dizzying speculative rise in 2017, bitcoin collapsed in 2018, losing 80% of its value, from nearly $ 20,000 to $ 3,700 in December 2018.

Bitcoin peaked on April 14, 2021 at $ 64,895.22, it lost around 48% on May 23, 2021 since its record. In August 2021, bitcoin goes above $ 50,000 after falling below $ 29,000 in June 2021.

Prudential rule for banks

Bitcoin (and other cryptocurrencies) are not tied to any underlying asset. In 2021, according to the rules of the Basel Committee, banks must hold equity of a value at least equal to their exposures to bitcoin or to other crypto-assets not linked to a traditional asset (dollar or others). A new public consultation on capital requirements is likely before the publication of the final rules.

Design

Economic school

Bitcoin’s theoretical roots lie in the Austrian school of economics and its critique of the current monetary system and interventions by governments and other bodies, which this school says exacerbates business cycles and massive inflation.

One of the topics that the Austrian School of Economics, led by Eugen von Böhm-Bawerk, Ludwig von Mises and Friedrich A. Hayek, focused on is the business cycle: according to Austrian theory, business cycles are the consequence inevitable monetary interventions in the market, whereby an excessive expansion of bank credit leads to an increase in the stock of bank credit in a fractional reserve system, which in turn leads to artificially low interest rates.

In this situation, entrepreneurs, guided by distorted interest rate signals, embark on overambitious investment projects that do not match the preferences of consumers at that time for intertemporal consumption (i.e. i.e. their short-term decisions and future consumption). Sooner or later, this generalized imbalance can no longer last and leads to a recession, during which companies must liquidate failed investment projects and readjust (restructure) their production structures according to the intertemporal preferences of consumers. As a result, many Austrian school economists are calling for this process to be abandoned by abolishing the fractional reserve banking system and reverting to gold standard-based currency, which cannot be easily manipulated by just anyone. what authority.

A related area in which Austrian economists have been very active is monetary theory. Friedrich A. Hayek is one of the best known names in this field. He has written some very influential publications, such as Denationalization of Money (1976), in which he postulates that governments should not have a monopoly on issuing money. Rather, he suggests that private banks be allowed to issue non-interest bearing certificates, based on their own trademarks. These certificates (i.e. currencies) should be open to competition and would be traded at varying exchange rates. Any currency that can guarantee stable purchasing power would eliminate other less stable currencies from the market. The result of this process of competition and profit maximization would be a highly efficient monetary system in which only stable currencies would coexist.

The following ideas are generally shared by Bitcoin supporters:

they see Bitcoin as a good starting point to end the monopoly of central banks in issuing money;

they strongly criticize the current fractional reserve banking system, which allows banks to extend their credit supply beyond their actual reserves and, at the same time, depositors to withdraw their funds to their checking accounts at any time;

the scheme is based on the old gold standard.

Specificity of Bitcoin

We must distinguish between bitcoin, cryptocurrency and on the other hand Bitcoin, the payment system in this currency. In these two aspects, Bitcoin differs from pre-existing systems on the following points:

unlike other monetary currencies, Bitcoin is not the embodiment of the authority of any state, bank, or business. The value of bitcoin is determined in a fully floating fashion by the economic use that is made of it and by the foreign exchange market. The rules organizing the monetary issue are determined solely by the free computer code of the Bitcoin software;

As a payment system, Bitcoin is distinguished by the fact that its operation does not require the use of a centralized infrastructure keeping accounts of the amounts held in order to ensure transactions. The role of guarantee and verification exists, but is assigned approximately every ten minutes to a computer of the network chosen at random according to its power;

Bitcoin is based on a cryptographic protocol the main purpose of which is, on the one hand, to resolve the so-called double payment problem, which had hitherto prevented the emergence of such a type of currency, and, on the other hand, to ” prohibit the falsification of stakeholder identifiers and the value of bitcoin stock in electronic wallets identified by a given address.

Monetary principle

From a monetary point of view, bitcoin is distinguished from other currencies by the major fact that the monetary aggregate is not designed to adapt to the production of wealth.

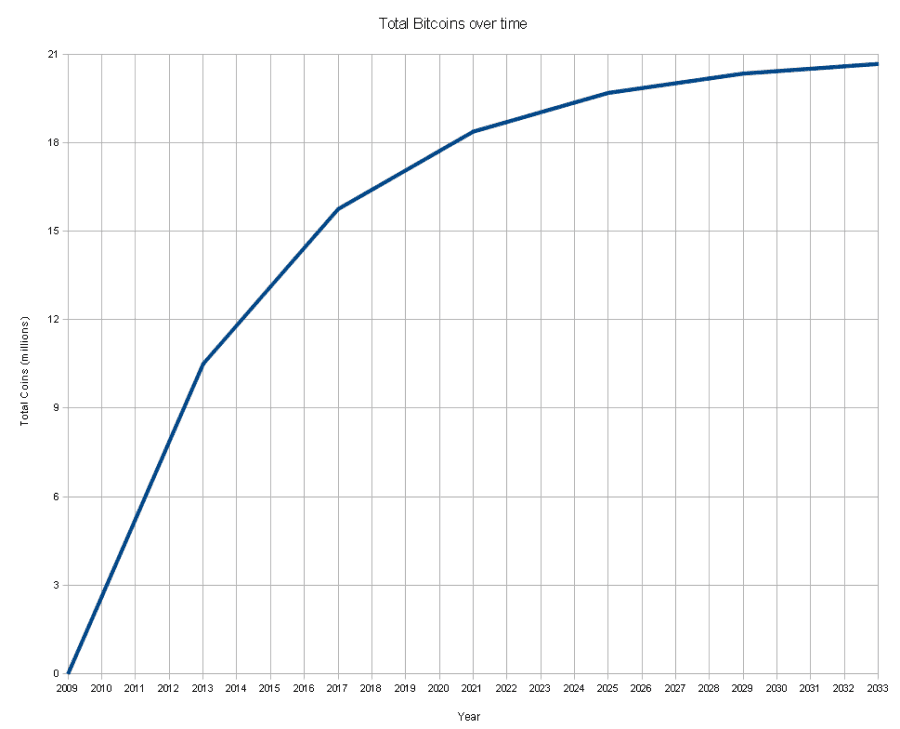

The total amount and the emission rate of the units are entered explicitly in the computer code of the software, according to a mathematical rule of the geometric series type.

Bitcoins are issued slowly and steadily, decreasingly, reaching a maximum amount of 21 million around the year 2140115.

All fiat currencies experience inflation, from low to high depending on the policies of their central bank. Conversely, bitcoin currency is likely to end up experiencing deflation, as the maximum amount of bitcoins that can be created is set in the software in advance at 21 million. In addition, bitcoins lost by users will never be replaced. This is why the Bitcoin project is considered by the community of its creators as an original experiment in economic terms, constituting a kind of test of the monetary theses of the Austrian school of economics. In fact, Friedrich Hayek, Nobel laureate in economics, in 1976 called for the reestablishment of monetary free will in his book For a true competition of currencies. The success or failure of Bitcoin is difficult to predict.

Scalability of the protocol

A limit of 1 MB per block to prevent malicious attacks

On July 14, 2010, shortly after the launch of the Bitcoin system, Satoshi Nakamoto created a limit of 1MB for each newly created block every ten minutes on the bitcoin blockchain.

At that time, transactions were free because few in number, and developers had a legitimate concern that attackers could “spam” the transaction network, arbitrarily creating huge blocks and permanently inflating the size of the blockchain. This limit was intended to prevent this kind of attack until a better solution could be put in place. Satoshi Nakamoto had proposed a solution that would involve increasing the block size to certain block heights, effectively increasing the limit to a predetermined rate and similar to how new bitcoins are issued.

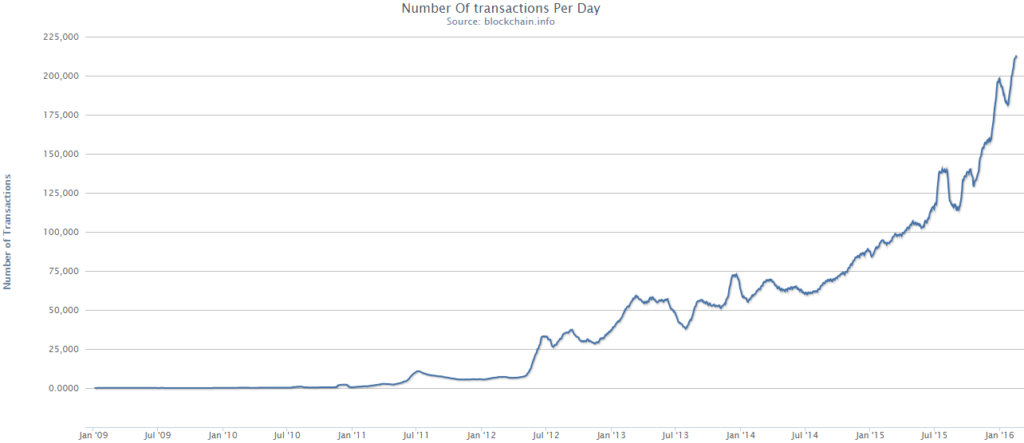

The scalability of the Bitcoin system has since been a constant source of debate in the community since the introduction of this block size limit. This 1 MB limit, initially thought to limit the number of transactions per second to seven, posed no problem at a time when the actual number of transactions hardly exceeded 2.3 transactions per second (2010). So, seven transactions per second was three times the volume of bitcoin’s busiest day at that time, leaving developers years to find a better solution. In addition, the protocol provided for the introduction of transaction fees over time, which would make this type of attack more costly and ineffective.

Saturation of transaction integration capacity

Starting in 2014, the success of the Bitcoin system led to a continuous rise in the number of transactions which eventually hit the 1MB limit in 2016. A developer, Gavin Andresen, initially proposed 20MB blocks, but this The increase was deemed too aggressive by the community. Another proposal, BIP101, proposed to increase the block size by 40% per year from 8MB which led to the creation of a new cryptocurrency, different from bitcoin, called Bitcoin XT117. Other proposals have been made like BIP100 with a 2MB block which leads to the Bitcoin Classic cryptocurrency and more aggressive “emerging consensus” approaches that allow users to “vote” on the best block size at a time. given through Bitcoin Unlimited. Other members of the community preferred not to favor an increase in the block size, but to change the protocol itself so that more transactions are integrated in a block by reducing their size or increasing the creation frequency. new blocks.

When the number of transactions eventually reached the block size limit, the pool of pending transactions became full. The only way to get a given transaction into the blockchain faster for a user was to increase transaction fees, which reached nearly $ 5 at the end of 2016. This made Bitcoin uncompetitive against existing services like Western Union. or Paypal on the strict basis of speed and cost.

Compromise of the New York Accord

The stalled debate on scalability weakens the Bitcoin Core system and leads to the growing success of the vote in favor of the Bitcoin Unlimited movement, especially among miners, in large part due to frustration at the lack of upgrading solutions. the actual scale. The development team’s approach, called segwit (segregated witness), of not increasing the block size limit, but partitioning the digital signatures of transactions into “extension block” differently, is not working. to achieve sufficient consensus.

A compromise121 is found in an industry consensus in 2017 called Segwit2x, which combines the segregated witness proposal with a block size increase to 2MB. This proposal is implemented on August 1, 2017 for segregated witness and the Block size increase goes into effect in November 2017 at block 494 784. It is a major update to the Bitcoin Core system.

Nonetheless, the scalability debate is still heated and a breakaway group unilaterally increased the block size to 8MB while rejecting the Segwit proposal on August 1, 2017. This decision led to the emergence of a new cryptocurrency. called Bitcoin Cash. The likelihood that another group decides to implement segregated witness without increasing the block size in November 2017 may lead to the emergence of another cryptocurrency, parallel to Bitcoin Cash and Bitcoin Core and whose blocks would be rejected afterwards. updating the Bitcoin Core protocol.

Bitcoin XT (created in August 2015), Bitcoin Unlimited (created in January 2016), Bitcoin Classic (created in February 2016 before being discontinued in November 2017), Bitcoin Cash (created in August 2017) and Bitcoin Gold (created in October 2017) are alternative cryptocurrencies to Bitcoin (also called Bitcoin Core) .

Distribution of wealth

Bitcoins are concentrated: the distribution of “wealth” is such that 2,100 addresses hold 40.2% of the total. Some of these addresses are dead (keys lost when a unit of bitcoin was not worth 1 cent)

Functioning

Principle

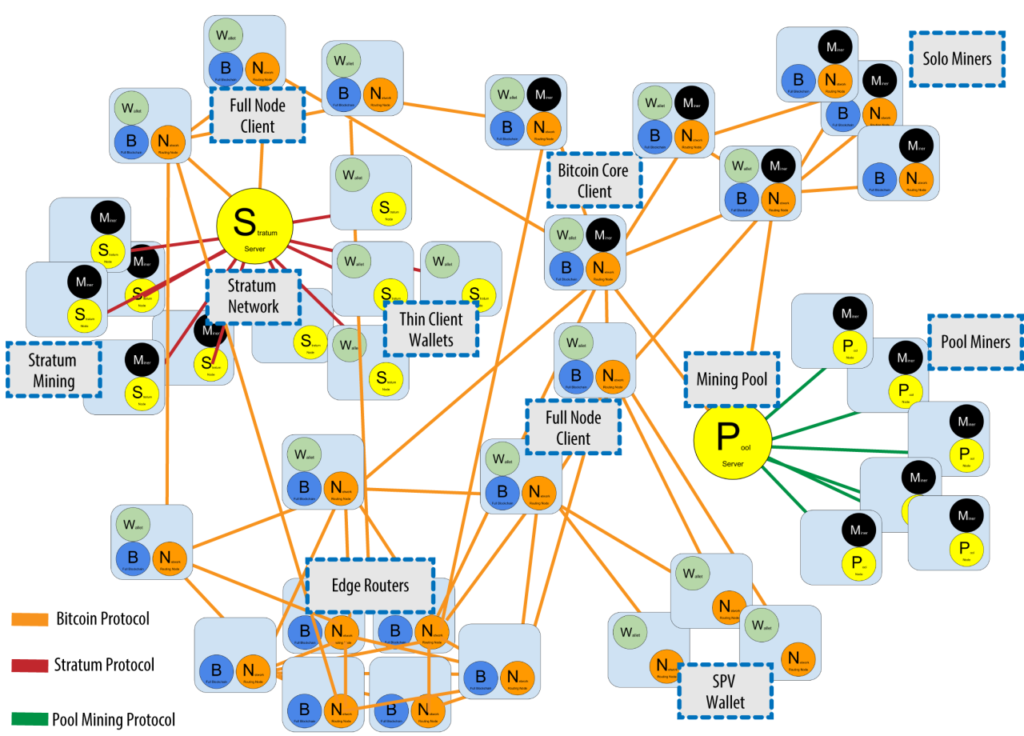

Bitcoin does not have an independent existence of the Bitcoin payment system which allows transactions to be made from one account to another, thanks to software called wallets, the authority being ensured by software from verification called minors. The data of all transactions constitute a public ledger under private law called a blockchain because of its structure and an agent uses bitcoins by recording their transactions in the Bitcoin system’s blockchain, said record referring to past transactions.

The Bitcoin system is computer-based, in other words, the Bitcoin system resides on the Internet. Downloading and installing the appropriate software allows you to become a Bitcoin user by interacting with hardware of your choice, including a smartphone or computer. To pay or be paid in bitcoin, the user must connect to the system, this connection offering two functions: the creation of any number of accounts on the one hand, and the ease of carrying out transactions consisting of the transfer of bitcoins. from an own account to the account of a third party.

The essential function of the Bitcoin system lies in the transactions which are subjected to a validity check by the competent computers and are irrevocably entered in a public register. This public ledger or blockchain can be viewed anywhere, as long as you have a connection to Bitcoin, and by everyone. During the consultation no alteration is possible. A bitcoin transaction is carried out in two stages:

Firstly, dedicated network nodes (the “miners”) create a new block by grouping together recently completed transactions and adding a header to them containing in particular the date and time, a checksum (“hash “) Which will also serve as the unique identifier of the block, and the identifier of the previous block;

Secondly, after having checked the validity of all the transactions contained in this new block and their consistency with the transactions already recorded, each miner adds it to their local version of the register (or chain of blocks).

The public register is copied in several copies. The complete history of all transactions can then be read by viewing all nodes in the network that manage (that is, have access to) a copy of the blockchain. The copy can reveal possible differences between files, in the event of disagreement. In this case, any differences between these copies must be resolved by the access software.

Here are some features of Bitcoin:

its functionalities are implemented by software made available in the form of free software; the user chooses his role in the system as well as the software he uses;

By design, the trusted authority of the system is not central, but distributed among the computers competent for the construction and maintenance of the blockchain.

Transactions

Transactions consist of debiting certain accounts in order to credit others.

They are made up of inputs and outputs. Each output includes an amount and the public key of the credited address, or more generally a program (a script) making it possible to authorize or not the transfer of the amount of this output to another transaction. Each input designates an output from a previous transaction and has a program (script) that provides the data expected by the script appearing in that output. The sum of the values of the outputs must be less than or equal to the sum of the values of the inputs, the difference constituting the remuneration of the minor.

When committing a transaction, scripts for each entry are executed; first the script of the entry itself, then the script of the earlier exit that the entry refers to. The transaction is only committed if the result is “true” for all inputs.

These scripts are written in an internal language designed by Nakamoto. This language is intentionally minimalist and not Turing-complete in order in particular to prevent the system from being able to engage in infinite loops. The use of scripts should allow the software to easily adapt to future developments and allow support for advanced features such as transactions involving multiple signatures or smart contracts.

Transactions made by a node are broadcast to its neighbors. These validate the transactions they receive and gradually consolidate them into a local pool before passing them on to their own neighbors. The valid transactions are thus broadcast step by step to all the nodes of the network, after a new check during each step.

Before permanently registering a transaction in the blockchain, the network performs several times a set of checks, including in particular that the outputs referenced by the inputs do exist and have not yet been used, that the author of the transaction is indeed the owner of the address credited in these outputs, and that the sum of the amounts appearing in the outputs of the transaction is much less than or equal to the sum of the amounts of the outputs referenced by the inputs.

The effect of entering a transaction in the blockchain is to prohibit any future reference to the outputs designated by the inputs of this transaction, and therefore to prevent a double expenditure of the amount of these outputs, which would amount to creating from scratch of bitcoins in an unauthorized manner. The only allowed creation of bitcoin from scratch is through a special transaction called Coinbase inserted at the start of each block in the chain to pay the miner who inserted the block.

A transaction is taken into account instantly by the network and confirmed for the first time after approximately 10 minutes. Each new confirmation reinforces the validity of the transaction in the transaction register.

Addresses

Each user can have any number of addresses that he creates through his wallet. Each bitcoin address has a public key – private key pair associated with it.

An address is equal to the 160-bit (20 bytes) cryptographic hash of its public key. There is thus a maximum of 2160 possible bitcoin addresses, or about 1048 (for comparison there are about 1047 water molecules on Earth, this also represents 2 × 1027 addresses available per mm2 of surface on the earth). A bitcoin address also has a prefix identifying the version number (0 by default) and a four-byte checksum. In all, a bitcoin address therefore occupies 25 bytes.

An address is represented in ASCII format thanks to a dedicated encoding of 58 alphanumeric characters: upper and lower case numbers and letters, with the exception of letters and numbers l, I, 0 and O, which Nakamoto excluded due to their resemblance in some typefaces.

Here is, as an example, the very first bitcoin address that received bitcoins: 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa.

To use the sum contained in an output of an existing transaction crediting a bitcoin address, the user must make use in the input of a transaction of the private key corresponding to the address by signing the transaction. The network checks the validity of this signature using the public key associated with the credited address, using asymmetric cryptography techniques. The operation is repeated for each entry of the transaction.

Wallets

Each user’s wallet contains their personal data, including the address, public key and private key of each of their accounts. It can also contain user-specific information built from the blockchain, for example the list of available transaction outputs or account balances.

The wallet software provides at least the functions of creating accounts, consulting accounts, constructing and sending transactions.

There is a choice of wallet software for all varieties of devices including smartphones. They differ in the extent of their ancillary functions and in their ergonomics.

The information contained in a user’s wallet is critical and must be strictly protected against any intrusion.

If the private key of an account is lost, the user can no longer access the transactions that fund this account, nor create new transactions from it. His bitcoins are permanently lost and will stay forever in the database without being able to change address. In 2013, a user lost 7,500 bitcoins, at the time worth $ 7.5 million, by accidentally throwing the hard drive that contained his private key.

The discovery of the private key of an account by another user allows the latter to impersonate the legitimate account holder and spend any bitcoins that may be found there, which is equivalent to theft of bitcoins.